Join a Credit Union in Wyoming: Personalized Financial Services for You

Join a Credit Union in Wyoming: Personalized Financial Services for You

Blog Article

Elevate Your Financial Experience With Credit History Unions

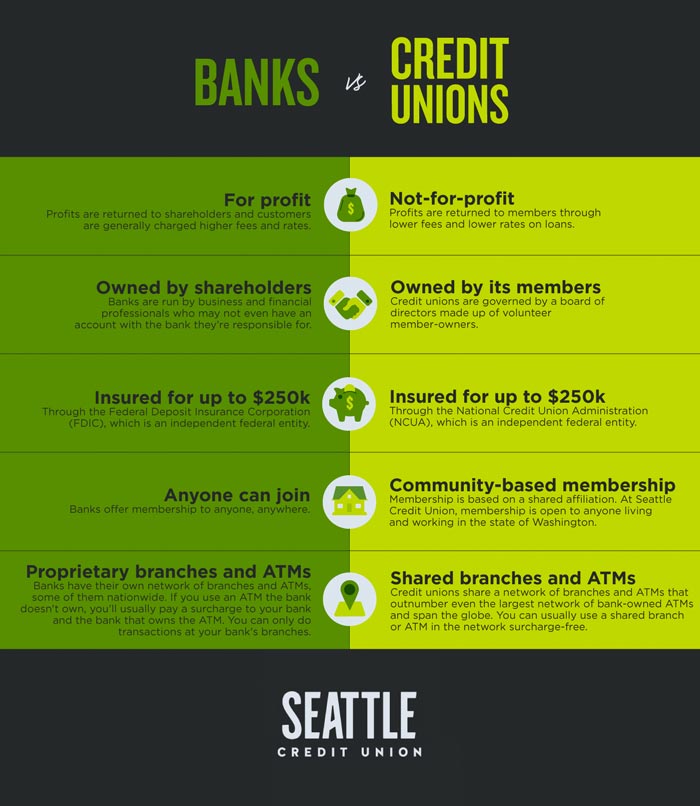

Credit score unions, with their focus on member-centric services and neighborhood participation, offer a compelling alternative to standard financial. By prioritizing individual needs and fostering a feeling of belonging within their membership base, debt unions have carved out a niche that reverberates with those looking for a much more individualized approach to handling their funds.

Advantages of Credit Report Unions

One more advantage of cooperative credit union is their autonomous structure, where each member has an equal vote in choosing the board of directors. This guarantees that choices are made with the very best passions of the participants in mind, instead of concentrating only on optimizing revenues. In addition, cooperative credit union often provide financial education and learning and counseling to assist members improve their financial proficiency and make notified choices regarding their money. Overall, the member-focused technique of lending institution establishes them apart as establishments that prioritize the wellness of their area.

Membership Requirements

Some credit rating unions might offer individuals who work or live in a particular geographic location, while others might be associated with certain firms, unions, or associations. Furthermore, household participants of present credit scores union members are usually qualified to join as well.

To end up being a member of a cooperative credit union, people are generally required to open up an account and keep a minimum deposit as defined by the establishment. In some cases, there might be one-time membership fees or ongoing membership fees. Once the subscription criteria are met, individuals can delight in the advantages of belonging to a credit rating union, consisting of access to individualized economic services, competitive rates of interest, and a focus on member contentment.

Personalized Financial Solutions

Personalized monetary solutions tailored to private needs and preferences are a characteristic of credit scores unions' commitment to participant fulfillment. Unlike conventional banks that typically supply one-size-fits-all services, credit history unions take a much more customized method to managing their participants' finances. By comprehending the distinct goals and circumstances of each participant, lending institution can provide tailored suggestions on savings, investments, lendings, and other financial items.

Moreover, credit unions normally offer lower fees and competitive rates of interest on lendings and cost savings accounts, even more enhancing the individualized economic services they give. By concentrating on specific needs and delivering tailored options, credit rating unions set themselves apart as trusted monetary partners committed to assisting members flourish monetarily.

Community Participation and Assistance

Neighborhood involvement is a keystone of credit unions' objective, reflecting their commitment to supporting regional initiatives and promoting significant connections. Cooperative credit union actively join neighborhood occasions, sponsor neighborhood charities, and arrange financial proficiency programs to educate members and non-members alike. By buying the areas they offer, credit rating unions not only strengthen their relationships yet also contribute to the total well-being of culture.

Supporting small companies is an additional means lending institution show their commitment to regional neighborhoods. With supplying small company loans and monetary advice, cooperative credit union aid entrepreneurs thrive and boost economic development in the area. This support exceeds simply monetary assistance; cooperative credit union frequently offer mentorship and networking chances to assist tiny businesses are successful.

Additionally, credit rating unions often participate in you can find out more volunteer job, motivating their participants and workers to repay with numerous social work activities - Credit Union in Wyoming. Whether it's participating in neighborhood clean-up events or arranging food drives, cooperative credit union play an energetic role in improving the top quality of life for those in demand. By focusing on community involvement and support, cooperative credit union genuinely symbolize the spirit of teamwork and common aid

Online Financial and Mobile Applications

Debt unions are at the forefront of this electronic transformation, supplying participants practical and protected ways to manage their financial resources anytime, anywhere. Online financial services offered by credit history unions allow members to inspect account equilibriums, transfer funds, pay bills, and view deal background with just a few clicks.

Mobile applications used by cooperative credit union even more enhance the banking experience by offering additional adaptability and access. Participants can carry out various banking tasks on the go, such as transferring checks by taking a picture, obtaining account alerts, and also contacting customer support click resources directly through the application. The safety of these mobile applications is a leading priority, with attributes like biometric authentication and security procedures to safeguard sensitive details. On the whole, cooperative credit union' online banking and mobile apps equip participants to handle their funds efficiently and firmly in today's hectic electronic globe.

Final Thought

In conclusion, credit report unions supply a distinct banking experience that prioritizes community participation, individualized solution, and member contentment. With lower fees, affordable passion rates, and tailored economic solutions, credit unions cater to private demands and advertise monetary wellness.

Unlike banks, credit rating unions are not-for-profit organizations possessed by their members, which usually leads to reduce fees and much better rate of interest rates on cost savings accounts, fundings, and credit history cards. Additionally, credit report unions are recognized for their customized customer service, with staff members taking the time to comprehend the distinct economic objectives and difficulties of each member.

Credit report unions frequently supply financial education and counseling to help members improve their economic literacy and make educated choices about their cash. Some credit rating unions over here might serve individuals who live or work in a certain geographic location, while others may be connected with specific business, unions, or organizations. In addition, household members of present debt union participants are typically eligible to join as well.

Report this page